Benjamin Franklin once said, “In this world, nothing can be said to be certain, except death and taxes,” and tax season is in full swing! For some of us, filing our taxes is just one more thing to check off our to-do list. But for others, a maximum refund can be a major budget boost for families that can help pay for education, a down payment on a home or build a savings account. That’s why accuracy and preparedness are key in making the most of filing your taxes. Luckily, there are plenty of tools –and free services for those who are eligible– to help make the process easier. Check out these helpful tips to get you started.

MAKE THE CALL

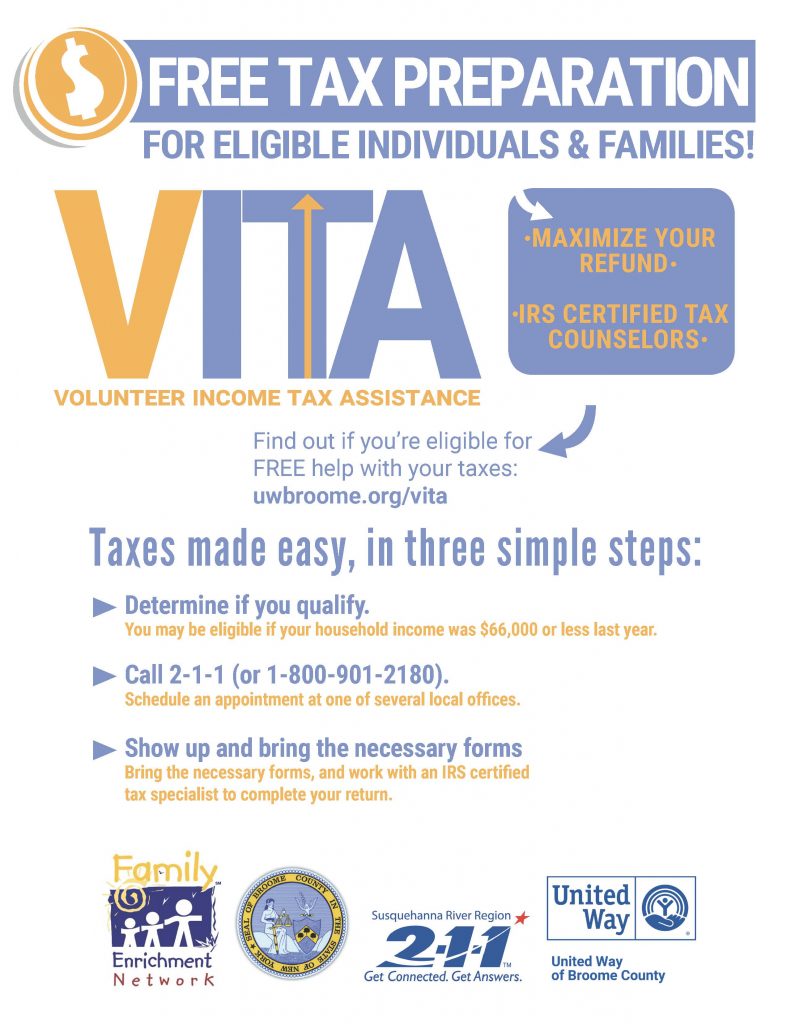

Don’t pay someone to prepare your taxes if you qualify for free tax prep! Call 2-1-1 or 1-800-901-2180 to see if you qualify for free IRS-certified tax prep. United Way of Broome County, has partnered with Broome County DSS and the Family Enrichment Network to bring this free service to our community.

In 2018, we turned tax season into over $2,200,000 of economic impact in Broome County. Call 2-1-1 to learn if you qualify and reserve your appointment. Space is limited.

ORGANIZE THE PAPERWORK

Second, you’ll need to make sure you have all of the necessary documents ready to go. They are a few key documents, such as your W-2 from your employer, that contain the majority of your filing information. You’re also going to need your ID, all 1099 forms you’ve received, your social security number, your spouse’s social security number (if married) and any dependent’s social security numbers.

AVOID SCAMS

With a new tax season comes a new opportunity for scammers and identity thieves, so be prepared. File early, never accept calls or emails to discuss your return, use well known and established tax preparers or online services and beware of unrealistic promises from tax preparers.

FREE SERVICES AND WEBSITES

Once you have the paperwork in order, you’ll be ready to start the filing process. But why pay a tax preparer when there are free tax prep services available that make submitting your tax return simple?

United Way has a simple, easy and free way to file your taxes. Through United Way’s Volunteer Income Tax Assistance (VITA) program, families with an income of $66,000 or less, or individuals with an income of $40,000 or less, can access an IRS-certified tax preparer at any currently available site throughout the community. VITA is free, confidential and guaranteed to help clients get the most from their returns. VITA sites are open throughout tax season. The only way to make an appointment is to dial 2-1-1 or 1-800-901-2180. To learn more about VITA or to find out where you can find our VITA sites, click here.

THERE’S MORE!

Through software powered by H&R Block, MyFreeTaxes.com helps you to input your data and the scans all of your eligible returns for accuracy and has IRS-certified professionals standing by to answer any questions. To find out more about MyFreeTaxes, click here.